How To Insure Your LEGO Collection

As a BrickNerd reader, you know (or hope) your LEGO collection is worth its weight in gold. This is especially true if you have any rare LEGO sets or one-of-a-kind MOCs made from a combination of your bricks and your brains. However, while AFOLs realize their LEGO collections are precious, many collectors don’t have insurance for their bricks.

When it comes to valuable possessions, we insure our homes and our cars, so why not our LEGO? If you’ve never thought about this (or just assumed your bricks were covered by your homeowners or renters insurance), consider this article your wake-up call. If your LEGO collection was damaged by an event like a flood or a fire, what do you think would happen? What about if it was stolen? None of us want to envision horrible scenarios like these, but they can happen.

If you’ve read our own Melissa Rekve’s story, you know that LEGO theft and destruction is a possibility. Luckily, she had insurance for her collection. BrickNerd’s Editor-in-Chief Dave was in a car accident this summer where our Mega Nerdly MOC met its demise (and inspired our Nerdvember survival contest). With these stories at the forefront of your mind and threats to your LEGO collection all around, you might be leaning towards getting your bricks covered by insurance.

View fullsize

View fullsize

For most of us, insurance of any kind can seem a bit mysterious and overwhelming to navigate. To help demystify it, I’ve talked to everyone from representatives from insurance companies to AFOLs like @yoyofirebricks who have become well-versed on this subject. After reviewing their insights, I’ve compiled this guide that explains what you need to consider about insuring your LEGO collection and how to get started.

What this guide is (and isn’t)

Before we dive in, I want to explain the best way to think about this guide. The world of insurance, especially as it applies to LEGO, is massive and complex. No single article can discuss everything that everyone around the world will need to know about this subject.

The world of insurance varies depending on where you live. Image via LEGO

Insurance changes not just from country to country but even varies among states, provinces, and sometimes even cities. Additionally, insurance companies vary in how they approach policies and coverage, so there just isn’t a single set of insurance rules that we can all reference.

That being said, some things remain relevant for just about every person who is thinking about insuring a LEGO collection. They include everything you’ll need to think about as you begin the process of getting your collection insured. As a result, this article will focus on these considerations. You can think of it as a way to get your bearings as you explore the world of insuring your LEGO collection.

Should I insure my LEGO collection?

The photos in this article are of the collections of some BrickNerd contributors. Specific owners will not be disclosed.

If you’re reading this article, you might be wondering if you need to insure your LEGO collection. Wouldn’t it be nice if there was some sort of dividing line between who needs insurance for their collection and who doesn’t? It turns out there is.

If you have more LEGO sets and pieces than the average family would have in their home, you should look into supplemental insurance coverage for your collection. Basically, if you’re a collector of LEGO, insuring your collection can be wise. With this in mind, it appears that many of us are massively under-insured and under-protected.

Should I get homeowners or specialized insurance for a LEGO collection?

Do you think these minifigures have homeowners insurance? Image Via LEGO

Once you realize that you should consider insuring your LEGO, you need to decide what type of insurance is best for you. There are two basic types of insurance that you’ll hear mentioned as you start researching this subject.

Homeowners or renters insurance

Specialized insurance for collectibles

You likely already have the first type of insurance and might think it’s enough to protect your LEGO collection. After all, homeowners and renters insurance typically protect specific groups of items (like toys and collectibles) in your home. However, this coverage often isn’t enough for an AFOL with a decent LEGO collection. Here’s what I learned about this type of policy:

Homeowners and renters insurance policies tend to have a maximum allowable payout within each group of items.

Most people are surprised to learn that collectibles often have their allowable payout capped at just a couple thousand dollars.

If you have a dozen or so LEGO sets (or fewer if you have higher-value ones like the Millennium Falcon), you can easily exceed that value.

The value of a few of these shelves quickly adds up to most homeowners insurance maximum payouts.

For these reasons, it’s typically best to consider a specialized insurance policy to cover your LEGO collection. Doing so will often give you more comprehensive coverage and protection for your beautiful bricks.

While we’re on the topic of insurance types, it’s worth mentioning business insurance. If you mix work and play to make money from your LEGO hobby, you can technically consider yourself a business. As a result, you could be eligible for business insurance, which often has better coverage but higher premiums.

What insurers provide specialized coverage for LEGO?

Once you decide to pursue specialized coverage for your LEGO collection, you’ll probably find yourself wondering where to look for it. You can start by asking your current insurer if they offer this type of coverage. However, you shouldn’t stop there.

Via American collectors insurance

You should also do a little research into other potential insurers that could be a good fit for your insurance needs. A great place to start this research is by conducting online searches and asking fellow AFOLs who have insured their collections. Also, if you live in the United States, you can check out companies like American Collectors Insurance or Chubb. Look around and make a list of insurance companies to check out and research.

If you’d prefer to have someone guide you through the process of finding insurance, you can always work with an insurance broker. Unlike an insurance agent who works for a single insurance company, a broker can sell policies from different companies. Their job is to listen to your needs and find the best company and policy for you, so they can be an excellent resource.

What questions should I ask before selecting insurance for my LEGO?

Grab a pen and some paper to write down your questions. Via BrickEconomy

As you reach out to each insurance company, come prepared with a list of questions and an inquiring mind. Before making a selection, it’s vital that you understand what an insurer can provide and what one of their specialized insurance policies will cover.

It can be hard to know what to ask when you’re first getting insurance for your LEGO. After all, you don’t know what you don’t know. You can start by asking some of the following questions:

Does the policy have limitations on coverage? For example, does it only cover a certain percentage of the collection’s total value?

Does the policy have restrictions on the types of damage or loss it will cover? For example, will the policy only cover theft and not destruction due to a fire or a flood?

Are there specific requirements to keep the policy? For example, do you need to arrange for periodic appraisals to keep your coverage?

Will coverage pay for the purchase value or the replacement cost of your collection? LEGO is an asset that tends to go up in value over time, so the cost to replace your sets will typically be more than the sets’ original purchase prices.

You’ll also want to ask the insurer if the company has insured a LEGO collection before. This can give you confidence that the company understands things like the fact that LEGO sets rarely depreciate in value (unlike other types of toys and certain collectibles). Working with an insurer that understands the details and scope of insuring a large LEGO collection can help you get as much reimbursement as possible if you need to file a future claim.

If the thought of asking all these questions makes you cringe, you’re not alone. A lot of people feel this way, but it can help to remember that the insurer you select will be working for you (and you’ll have the receipts to prove it). You deserve to get the information you need to confidently make a decision about insuring your LEGO collection. Once you make that decision, take your time to ask any follow-up questions and carefully read the terms of your policy. You want to be armed with information before you ever have to file a claim.

How do I catalog my LEGO collection for insurance?

When you’re getting your LEGO collection insured, you’ll need to figure out what it’s worth. Yes, I know that many AFOLs will tell you that their LEGO collection is priceless (or they may not want to admit how much they’ve spent on it over a lifetime). However, insurers need a more concrete answer than that. That’s because it’s impossible to insure something if you don’t know what it’s worth.

Figuring out the value of your LEGO collection can be a time-consuming and intricate process (especially if you have a large collection or a lot of bulk bricks). You’ll first want to take an accurate accounting of your collection. Before you panic at the thought of cataloging your entire collection, just think about each small step. For the first step, it can be helpful to divide your LEGO collection into groups. For example, you might place your LEGO in the following categories:

Brickset is one way to keep track of your LEGO collection. Image Via Brickset

Sealed sets and their condition

Built, used or open sets

Loose parts, either sorted or basic bulk

Minifigures and their condition

Your MOCs

Other LEGO-related items like gear, books, storage containers or memorabilia

You can keep track of your sets and bricks in a spreadsheet or by using a tool like Your Collection from Brickset, a Rebrickable list, or even an unopened store inventory in BrickLink. You’ll also want to take clear photos and videos of the items in your LEGO collection, as well as hold onto your receipts if needed. Being thorough and organized as you catalog your collection will serve you well as you move forward.

What information should I document about my LEGO collection?

As you take inventory of your collection, you might wonder what other information you should record aside from LEGO set names and numbers. You can ask your insurer for their specific requirements, but here are things that you should likely mention about each piece in your collection:

Is your Millennium Falcon still in the box? Image via LEGO

Condition: You’ll need to track the condition of each of your LEGO sets. You should record if each item is sealed in box, sealed in damaged box, new (out of the box but not built), lightly used (built but in near-perfect condition), or heavily used (lots of wear and tear or damage).

Completeness: It’s important to document whether your sets are missing any pieces, including the original box and instructions or minifigures.

Value: Websites like BrickLink, Brickset, and BrickEconomy are great resources to check for value information. Keep in mind that values can and will change over time, so you’ll have to regularly update this information for your insurance provider.

Amount: When it comes to loose bricks, you’ll need to know the amount you have. Measures like weight, volume by bag, or previous order forms from LEGO Pick a Brick or LUGBulk are not as helpful as an accurate accounting of each piece but are better than nothing.

Rarity: Obviously, limited edition and exclusive sets are more valuable, so you’ll want to make note of these in your collection. Additionally, some rare LEGO sets and minifigures don’t have an established value. In these cases, you’ll need to work closely with your insurance company and an appraiser to arrive at a dollar amount for coverage.

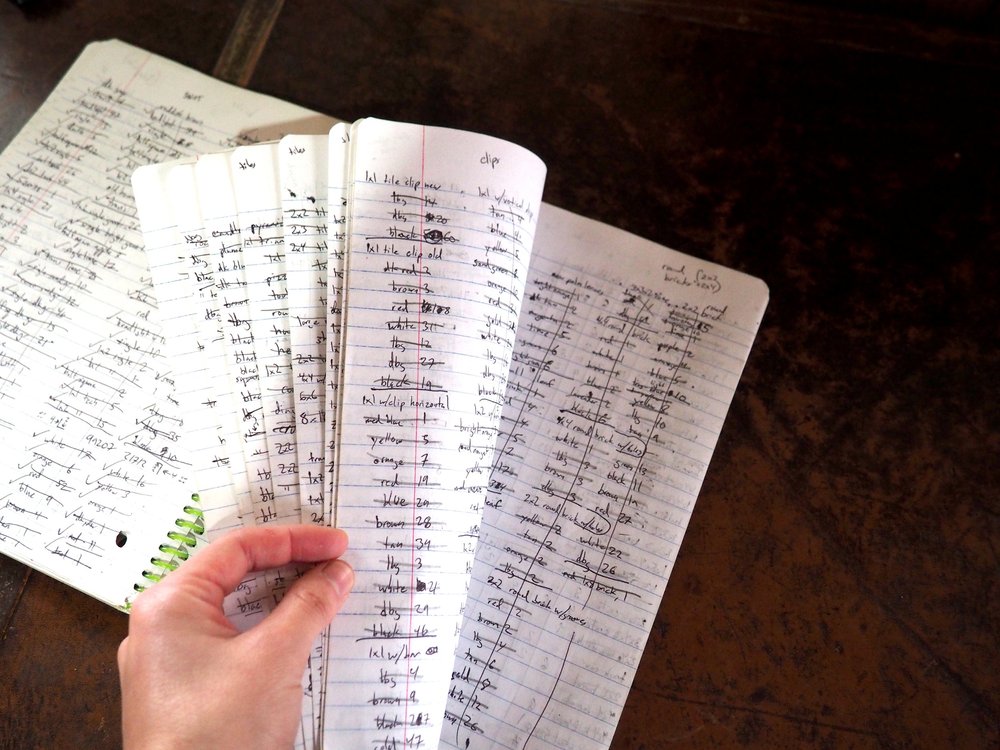

One BrickNerd contributor counted and documented every piece in their LEGO collection.

Factors like these determine the value of your collection and can help you and your insurer decide how much it would cost to replace it. Additionally, you can consider getting a professional appraisal of your collection. In fact, some insurers might require it. When working with an appraiser, an expert will assess your collection and help determine its value.

LEGO appraisers may be rare, but most insurance companies will work with a collectibles team or company they trust. Occasionally, owners of second-hand LEGO store have been approached for their expertise appraising a LEGO collection. Having this type of guidance can be a huge help for very large and unique collections.

Can I insure my custom LEGO MOCs?

If you have spent any time creating your own LEGO models (also known as MOCs), you probably have questions about how to determine their value. As you might expect, this is a complex question that doesn’t have one concrete answer. It’s relatively easy to determine the cost of the LEGO bricks and pieces that you used to create your build… if you counted them as you created it. After it is finished it is harder to get an accurate estimate, no matter how many kids ask you how many pieces are in it at a LEGO convention.

Some MOCs even incorporate LEGO sets, rare figures, and bulk brick, so insuring them gets complicated quickly.

However, it’s more difficult to place a value (from an insurance perspective) on your time and creativity. As a result, you may want to consider working with a professional appraiser who has a deep understanding of LEGO if you want more than just the individual pieces of your MOC covered. Their knowledge can help assess value and corroborate documentation for your insurer.

Additionally, you could explore insuring your MOCs the same way that professional artists approach insuring their artwork. This would typically involve purchasing business insurance to cover the value of what you could sell your MOC for. Obviously, this enters another somewhat gray area of the insurance world. Intangible value for art can include the time spent creating it, any sentimental value, who created it, if it is well known in the community, and any expected revenue from displaying or selling it. As a result, no matter which approach you take to insure your MOCs, you’ll likely be working very closely with your insurer and LEGO experts during this process.

What are the pros of insuring your LEGO?

Your LEGo is precious and should be protected. Think of all the time and effort it would take to replace this setup!

The advantages of getting insurance for your LEGO collection is pretty clear. Coverage can give you peace of mind, especially if your collection has special financial or sentimental value. If you’ve invested a significant amount of time in your collection, you know that LEGO is more than just a toy. It’s an investment that should be protected.

When you have insurance, you have protection for your investment in the event the unthinkable happens. (And as much as I don’t want to admit it, the unthinkable happens often—this year alone, the LEGO community has seen theft from cars and locked studios, fire and flood damage, and multiple car accidents.) This protection translates into reimbursement if your collection is damaged or stolen. While money alone won’t fill the emotional void after losing a carefully cultivated LEGO collection, it does help jumpstart replacing it and beginning a new collection.

What are the cons of insuring your LEGO?

Needing to document your collection is a great excuse to organize and sort it as well.

As you can imagine from what we’ve already discussed, one of the biggest disadvantages of insuring LEGO is that the insurance process can be arduous. This includes the time and commitment of documenting your collection, researching insurance policies and providers, and reading the fine print of policies. You’ll also have to consider the time spent communicating with your insurance provider to make updates as your collection grows and changes.

While it’s true that this process takes a lot of time and effort, you can get through it with patience. For example, you can catalog your entire collection if you steadily work through it a little bit every day. Additionally, considering the goal is to protect yourself and your precious LEGO collection, it’s well worth the time and effort.

Another disadvantage is the increased cost of insurance premiums, as supplemental coverage means additional costs. However, you can keep your premiums more affordable by talking with your insurer to avoid paying for more insurance than you need. You can also lower the cost by researching different insurance providers or opting for a higher deductible.

Specialized insurance for LEGO comes with increased cost.

A deductible is the amount of money that you would have to pay before the insurance begins to pay out. When you have a higher deductible, you’ll have a lower premium. This is a calculated risk, but opting for a higher deductible can make specialty coverage for your LEGO collection more affordable.

A final disadvantage to consider is how challenging it can be to get reimbursed after a loss. Getting paid after something goes wrong isn’t always straightforward and can be a long, stressful process that might not provide you with the full replacement value for your collection. Even so, a person with some insurance will get more back if their LEGO collection is lost, stolen, or destroyed than someone without insurance will get (which likely will be nothing).

Should you insure your LEGO? Some final thoughts.

The topic of insuring LEGO comes with a lot of variation, subtlety and vagueness, but hopefully this article gives you a place to start as you begin to explore getting your collection covered. Ultimately, you’ll want to use the information provided here as a jumping-off point as you look for the best policy to protect you and your LEGO.

It’s wise to keep two points in mind as you begin this journey:

Start gradually as you catalog your collection to avoid feeling overwhelmed. Begin by taking inventory of your sealed sets and built sets before moving onto smaller pieces and parts of your collection. And start documenting any new additions to your collection so you won’t have to go back and do it later.

Never be afraid to ask questions. Your insurance company works for you and you pay for that privilege, so you deserve answers to all your questions. It may take time and research to get answers, but be willing to learn as you go about the process of insuring your LEGO collection.

If you keep these two points in mind, it can make the process of insuring your LEGO a little easier. Hopefully nothing ever happens to your LEGO collection, but getting insurance will provide peace of mind and financial recompense just in case.

Do you want to insure your LEGO collection? What do you think would be the biggest reasons for or against getting insurance for your LEGO? Let us know in the comments below.

Do you want to help BrickNerd continue publishing articles like this one? Become a top patron like Charlie Stephens, Marc & Liz Puleo, Paige Mueller, Rob Klingberg from Brickstuff, John & Joshua Hanlon from Beyond the Brick, Megan Lum, Andy Price, Lukas Kurth from StoneWars, Wayne Tyler, Monica Innis, Dan Church, and Roxanne Baxter to show your support, get early access, exclusive swag and more.